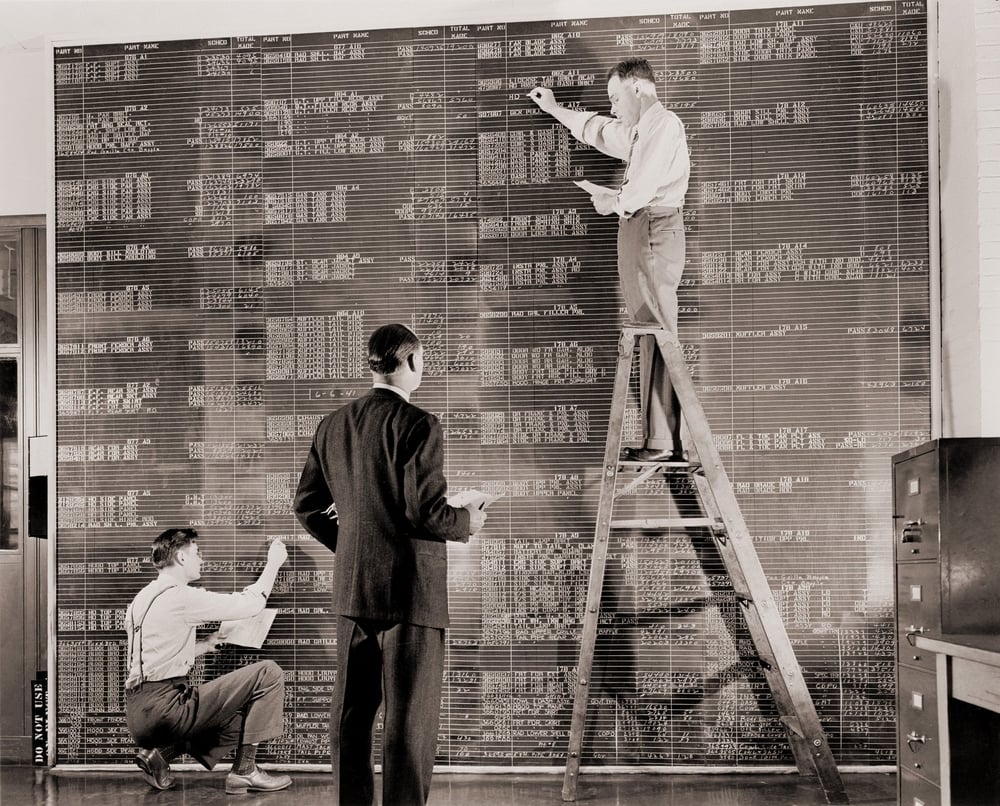

Start 2016 By Moving Away From Spreadsheets

/You have been through the New Year’s resolutions, some will be kept and some already broken, now it’s time for the real change makers. If you’re looking to achieve a joined up business in 2016 and to understand the key drivers for your business, it's time to look at ways to introduce tools that can help you extract the information you need from your accounting / ERP system. One of the quickest and most effective steps you can take is through technology. In the first of a three part series we’re investigating other platforms to enable true financial reporting, planning and rolling forecasts.

So it’s time to put away the Excel spreadsheets and embrace new cloud-based software tools that offer accuracy, accountability and flexibility. Here's what you need to know about the downsides of Excel and how the Cloud overcomes them to save your company serious time and money.

The Risks That Excel Poses

There are a number of drawbacks inherent within Excel. One of the biggest is that Excel performs poorly when your employees need to share data or implement complex analysis. This is due to a lack of safeguards built into the product when it comes to proper data quality and governance, which leads to poor accountability.

For example, when multiple employees are involved with a project, there is no log of changes built into Excel. As a result, when financial reporting is off, it can be difficult to know which party is responsible. Financial reports are calculated using data and formulas. However, what a team member inputs in terms of data might be changed or reworked by another employee or team. These changes often occur without anyone noticing. The lack of visibility regarding the numbers and data behind these changes is a huge cause of major financial reporting errors.

Excel Lacks Support

At the same time, when companies produce financial information, Excel lacks ways to provide proper financial documentation, such as explanatory text and images. This means that the work your accountants perform is often misinterpreted by people outside of financial departments or simply not understood at all, which leads to misreporting, poor governance and a lack of communication.

Excel also lacks depth and flexibility, which means a lack of financial reporting capabilities. Unfortunately, statistical tools and powerful algorithms that not only examine high risk factors, but also do so on an automatic basis, are missing from Excel. That's why your company needs a robust package that offers more comprehensive reporting tools and automation.

Utilise the Cloud and SaaS

The Cloud overcomes the limitation of Excel. Software-as-a-service (SaaS) financial solutions in the Cloud offer synergies with business intelligence, big data tools and predictive analysis. Not only can your teams collaborate far better in the cloud, but they can also utilise new technologies that track data in real-time, make predictions about this financial data and automate much of the financial reporting process.

The Cloud also offers a solution to the severe data limitations of Excel. As data grows, Excel is buckling under the pressure. To overcome this, your business may resort to breaking up data into multiple projects or maintaining a number of worksheets and workbooks, an unwieldy and inefficient solution. Cloud-based solutions ensure businesses can handle nearly unlimited data. Furthermore, SaaS allows you to easily scale your company's financial software as it grows.

Clear Reporting and Visibility

Using cloud-based solutions for financial reporting, accounting and data entry offers a tremendous advantage over Excel. Your employees will no longer need multiple spreadsheets scattered across different computers for the same project. One centralised program allows for easy tracking of changes and ensures uniformity and focus on each project.

The nature of the Cloud means you get the flexibility of Excel coupled with functionality and controls built into financial reporting tools. This means your team can crunch data, make financial projections and prepare financial reports while being able to better spot red flags, such as cost overruns, before they balloon. This provides a more holistic approach to accounting that Excel has failed to provide in recent years.

You can also assign tasks to your team members allowing them to work in unison with each other rather than crossing over on the same tasks. Furthermore, Cloud solutions that have the same look and feel as Excel, make it easy for teams to embrace robust reporting and analysis software. For the right solution that can extract the data from your accounting / ERP system enabling you to report accurately and timely to the business does not have to be costly, but in fact can save your company time and money.

In our next article we’ll be exploring collaborative SaaS planning tools with an Excel look and feel with the power of a database. If you can’t wait and would like to find out more now, email us info@agencydna.com or call us on 020 3394 0046 and we can come and have a chat to you.